Corporate Governance

EXTRACT FROM THE CORPORATE GOVERNANCE REPORT

Burckhardt Compression is committed to responsible corporate governance. The company adheres to the Directive on Information Relating to Corporate Governance (DCG) issued by SIX Swiss Exchange, where applicable to Burckhardt Compression, and the “Swiss Code of Best Practice for Corporate Governance” issued by economiesuisse.

In the 2020 fiscal year, Burckhardt Compression has set-up a new Code of Conduct for business partners. In this fiscal year, Burckhardt Compression started to refresh the Code of Conduct for its employees, which will be released in the next fiscal year. In addition, a Speak Up channel for all internal and external stakeholders of Burckhardt Compression will be launched in the next fiscal year as well.

This report is structured in accordance with the DCG’s outline and numbering. Unless otherwise noted, the information presented reflects the situation on March 31, 2021.

GROUP STRUCTURE AND SHAREHOLDERS

Management structure

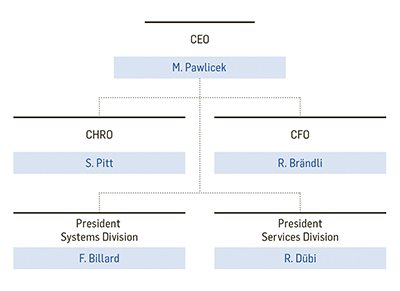

Burckhardt Compression is managed through a divisional organizational structure consisting of two divisions, the Systems Division (compressor manufacturing business) and the Services Division (compressor services and components). The management structure of the Burckhardt Compression Group is given in the organizational chart below:

Significant shareholders

According to information available to the company from the disclosure notifications of the SIX Swiss Exchange AG, the shareholders listed in the following table reported shareholdings of at least 3% of the voting rights as per March 31, 2021. In accordance with the company’s Bylaws, the voting rights of NN Group N.V. and Atlantic Value General Partner Limited (Mondrian) are limited in each case to 5.0% of the total number of BCHN registered shares recorded in the share register:

| Name | Country | % of shares |

|---|---|---|

| MBO Aktionärsgruppe (Valentin Vogt, Harry Otz, Leonhard Keller, Martin Heller, Ursula Heller, Marcel Pawlicek) | CH | 12.4 |

| NN Group N.V. | NL | 10.3 |

| Atlantic Value General Partner Limited (Mondrian) | GB | 5.0 |

| BlackRock, Inc. | US | 3.0 |

| UBS Fund Management (Switzerland) AG | CH | 3.0 |

| FEDERATED HERMES, INC. | US | 3.0 |

More detailed information on the disclosure notifications is available on the website of the SIX Swiss Exchange’s Disclosure Office (https://www.ser-ag.com/de/resources/notificationsmarket-participants/significantshareholders.html#/).

BOARD OF DIRECTORS

The Bylaws stipulate that the Board of Directors consists of a minimum of three and a maximum of seven members. Since the Annual Shareholder Meeting 2020, all members are non-executive and independent members of the Board of Directors in the context of the Swiss Code of best Practice for Corporate Governance from economiesuisse. The composition of the Board of Directors is as follows:

| Name (Nationality) | Function | First elected | Term expires |

|---|---|---|---|

| Ton Büchner1 (CH/NL) | Chairman, non-executive; Chairman SC | 2020 | 2021 |

| Urs Leinhäuser (CH) | Member, non-executive; member AC | 2007 | 2021 |

| Dr. Monika Krüsi (CH/IT) | Member, non-executive; member SC, Chair NCC | 2012 | 2021 |

| Dr. Stephan Bross (DE) | Member, non-executive; member NCC | 2014 | 2021 |

| David Dean1 (CH) | Member, non-executive; Chairman AC | 2019 | 2021 |

| Valentin Vogt2 (CH) | Chairman, non-executive; Chairman SC | 2002 | 2020 |

AC = Audit Committee

NCC = Nomination and Compensation Committee

SSC = Strategy and Sustainability Committee

1 From July 4, 2020

2 Until July 3, 2020